Enhancing Air Service

The Lake Superior Community Partnership (LSCP) acknowledges the importance of reliable, convenient, and affordable air service out of Marquette Sawyer Regional Airport (MQT) as an economic development matter of great importance to our region. Air service, which can support businesses and residents in meeting their goals, opens access to bigger markets and experiences necessary to improve the business climate and quality of life in our region. Unfortunately, as the only commercial airport in the Upper Peninsula without an Essential Air Service (EAS) designation, Marquette Sawyer has experienced a degradation of service due to factors outside of its control, including shortages of pilots and planes and competition with government subsidy programs. However, with the right data, tools, and relationships, the LSCP believes more frequent and better-timed air service can be re-established at Marquette Sawyer. It won’t happen overnight, but steady, consistent efforts will pay dividends.

The LSCP has a long history of working hand-in-hand with Marquette County, Marquette Sawyer Regional Airport, and other partners to enhance air service. This includes coordinating efforts through the LSCP’s Transportation Taskforce to establish the Marquette—Minneapolis route in 2017. This page provides access to key documents and context on the LSCP’s efforts to work alongside partners in achieving enhanced air service at Marquette Sawyer Regional Airport.

Current Environment

Marquette Sawyer currently has three daily flights: two to Chicago (via American/Envoy) and one to Detroit (via Delta/Sky West). In 2023, the airport handled 896 commercial departures, down 39% from the 2021 peak of 1,463 departures (which included two additional near-daily routes to Detroit and Minneapolis). Despite challenges, Marquette Sawyer accounted for 30% of all U.P. commercial traffic in 2022.

The business climate for airlines has changed dramatically since 2020, and the pandemic, which accelerated an existing shortage of pilots, is already making rural air service challenging. While airline passenger numbers took a dive during the pandemic, starting in September 2023, they have risen above 2019 levels. The first quarter of 2024 brought a 3.4% increase above 2019. While traffic is returning and seat capacity is up by 7%, the number of flights has been reduced by 5.7% between 2019 and 2024, with non-Hubs (such as Marquette Sawyer) being hit the hardest (-18.1% flights and -1.2% seats). Due to this, the environment for additional flights is significantly more competitive than a few years ago.

As local partners work to add service, three key trends currently dominate airline decision-making practices: pilot availability, aircraft availability, and profitability.

Pilot Availability: Major airlines have paused hiring new pilots. While on one hand, this may lead to greater stability for regional airlines which typically serve airports like Marquette Sawyer, the national pilot shortage estimated to be in the tens-of-thousands by 2030*. This shortage is created via a combination of more pilots following a civilian path to the career, which tends to be more expensive, and mandatory retirement age rules limiting the active pilot pool. Airlines are not immune to the general labor shortages hitting the U.S. economy overall.

Aircraft Availability: Orders from Boeing and Airbus are delayed across the entire sector, limiting fleet growth. This is primarily due to a shortage of engines, cabin interiors, and other components. Additionally, airlines are retiring smaller regional jets that typically serve airports like Marquette Sawyer. Fortunately, Marquette Sawyer has proactively worked to prepare for this change and is currently the only airport in the U.P. with a

Profitability: Airlines seek passenger load factors above 85% on every flight to remain profitable; some lower-cost airlines require 90%. While Marquette Sawyer has commonly hit this target in peak summer months, its overall load factor for the year falls below this amount, usually in the 70s.

What’s Being Done

- Data Collection: The LSCP has been working with partners to collect vital data to compile the full picture of current demand at Marquette Sawyer.

- Grants: The LSCP has assisted Marquette Sawyer in applying for grants, including a $750,000 grant to fund a minimum revenue guarantee (see later on this page for more about MRGs).

- Strategic Planning: The LSCP has participated in a private-public sector group focused on the long-term strategy for making Marquette Sawyer “Best in Class.”

- Meetings with Airlines: The LSCP is working with a consultant to coordinate meetings with airlines to directly make the case for more service to Marquette Sawyer.

- Policy Changes: The LSCP advocates for changes to current policies to improve Marquette Sawyer’s competitiveness..

How You Can Help

While this page provides background data on efforts to enhance air service, success in this endeavor ultimately comes down to each of us as businesses and individuals doing what we can to support our local airport. Below are ways you can directly show support for stronger local air service.

Thank you to those who pledged to support local air service!

| Business | Name | Position |

| Informa Markets | Lee Marana | Director of Health IT Content |

| Marcotte Law, PLLC | Wendy Marcotte | Managing Member |

| Northcross Group | Chris Bender | President |

| Bell Financial | Jesse Bell | President |

| Chocolay Township | Richard Bohjanen | Supervisor |

| Personal | Sally Davis | Retired |

| Enright Familly Restaurants | Steve Whelan | Owner |

| Siren | Adela Piper | CEO |

| Wilbur Design & Construct | Wilbur Jennings | Owner |

| Incredible Bank | Christian Palomaki | V.P. Business Banking Officer |

| Marquette-Alger RESA | Greg Nyen | Superintendent |

| City of Marquette | Karen Kovacs | City Manager |

| UPHS Marquette | Tonya Darner | CEO |

| Resolve Surgical Technologies | Megan Osorio | President & CEO |

| Mommaerts Mahaney Financial Advisors | Jon Mommaerts | President |

| County of Marquette | Scott Erbisch | County Administrator |

| Roberts Financial Services, Inc. | Bruce Roberts | President |

| Range Bank | Roxanne Daust | President & CEO |

| TTWAG Consulting | Tom Tourville | Partner |

| UP Health System Marquette | Peter Camilli | VP Medical Group Services |

| UPHS-Marquette | Lisa Long | Chief medical officer |

| Mark Aho Financial Group | Eric Froberg | Financial Advisor |

| Wilbur Design and Construct | Gianna Ferraro | Director of Marketing |

| Leppanen Anker LLC | Gabriela Anker | Principal / Founder |

| UPHS-Marquette | Lisa Long | Chief medical officer |

| Flourish Financial Partners, Ameriprise Financial | Scott Knaffla | Owner |

| County of Marquette | Kim Ketola | HR Assistant |

| Marquette County | Brett Hubbard | Executive Assistant |

| Carlisle/Wortman Associates | Mark F. Miller AICP | Community Planner |

| Lake Superior Community Partnership | Ashley Szczepanski | Marketing Director |

| Travel Marquette | Susan Estler | CEO |

| Upper Peninsula Health Plan | Melissa Holmquist | CEO |

| Breneman Advisors, LLC | Brady Buher | Financial Analyst |

TELL others what you’ve learned.

USE Marquette Sawyer Regional Airport whenever possible.

INVEST in the efforts to enhance air service.

ADVOCATE for changes to Essential Air Service that make more sense.

Demand and Leakage Study

In Fall of 2023, the LSCP contracted with Mead & Hunt to conduct a demand and leakage (D&L) study based on air service data available as of June 30, 2023 for Marquette Sawyer (MQT). A D&L study shows what type of demand is expected to originate from a particular travel shed (also known as a “catchment area”) and what portion of that demand is using the local airport. Overall, the report found that less than half (48%) of the demand originating in the expected catchment area for Marquette is flying out of MQT. The study compared MQT to three other non-EAS airports: Appleton (ATW), Green Bay (GRB), and Chicago O’Hare (ORD). As outlined in the report, decisions of which airport to fly out of often come down to three factors: airfares, nonstop service availability, and the quality and capacity of air service.

Key Findings:

- Our catchment area is likely generating a true demand of 153,143 passengers per year.

- 52% of that demand is choosing other airports, including 15% to ORD, 11% to GRB, 10% to ATW, and 17% to other airports (likely Iron Mountain – IMT and Escanaba – ESC).

- Our top domestic destination is Detroit (DTW), which has 16,295 annual passengers. Of that, 36% are choosing other airports likely due to cost and timing of flights.

- The average cost of a flight out of MQT was $308, compared to $196 for ORD, $208 for ATW, and $286 for GRB.

- When you factor in the time it takes to drive, and the likely hotel stays at those airports, both ATW and GRB lose their advantage in a 1:1 match-up but likely benefit from better schedules and more direct routes. GRB currently has eight direct routes, and ATW currently has nine.

- If changes can be made to retain just 10% of the demand not currently using MQT, it would add approximately 15,000 additional passengers per year – enough to support another daily flight.

True Visitation Study

In the fall of 2023, the LSCP contracted with Mead & Hunt for a True Visitation Estimate Study. A True Visitation Estimate is a location-based demand analysis that uses strength of the destination’s overall visitation to identify air service development opportunities. A True Visitation Estimate differs from traditional retention/diversion studies, which rely on delayed and non-dynamic data, in that it uses location-based cell phone Global Positioning System (GPS) data. This study identifies visitor travel patterns and estimates the number of people going to and from the destination. MQT and its community partners can use the results of the study for ongoing air service development efforts and amplify its advertising and business development strategies. The findings can also assist MQT and its community partners in developing a data-driven unified air service development strategy.

Key Findings:

- Visitation to the Marquette area was estimated at 1.27 million visits in 2023 from beyond 50 miles. Visitation increased by 7% from 2019.

- The Great Lakes region (beyond 50 miles from the Marquette area) was the largest region for visitation, with nearly 1.13 million visits in 2023; top markets within that region were Detroit MSA (133,000) and Grand Rapids-Wyoming MSA (68,000).

- The top five outbound destination visits from MQT were Chicago, IL; Minneapolis, MN; Orlando, FL; Denver, CO; and Dallas, TX.

- The top new market opportunity is the restoration of service to Minneapolis-St. Paul International Airport (MSP) by Delta. Minneapolis was the fifth largest inbound visitation metro area and improved compared to 2019 and 2022.

Marquette Business Air Service Needs Survey

In April 2024, the LSCP conducted a survey of the Marquette business community seeking input on priorities for air service enhancements and connecting business needs to specific high-impact areas with existing or potential air service: Detroit, Chicago, and Minneapolis. The LSCP received 468 responses. The survey was performed as part of the efforts to apply for $750,000 in state funds to support air service enhancements (which was successfully awarded).

Key Findings:

- 68% of respondents had customers, vendors, or other business interests in Minneapolis.

- 78% of respondents had customers, vendors, or other business interests in Detroit.

- Of the three locations, Detroit was the top priority for expanding air service, followed by Minneapolis and Chicago.

- 76% of top domestic destinations were in the Midwest and East Coast.

Essential Air Service (EAS) – What Is it?

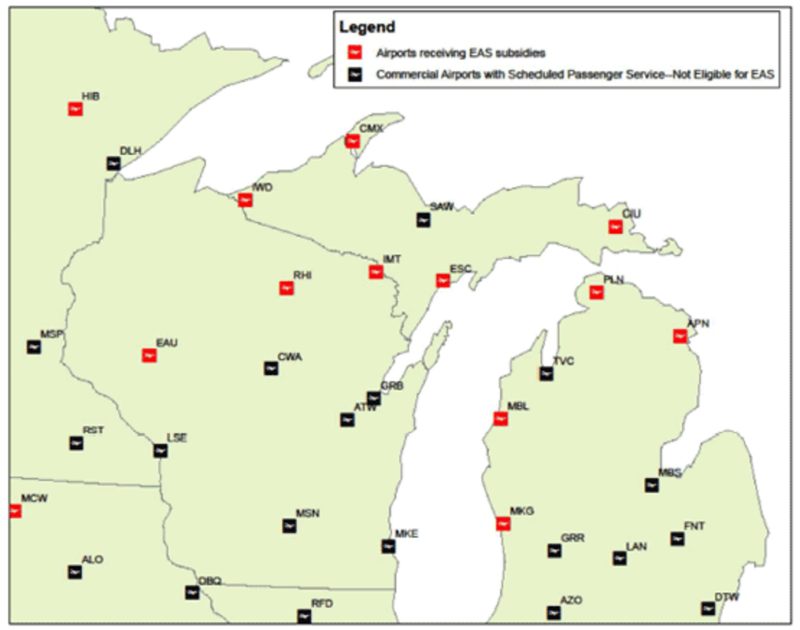

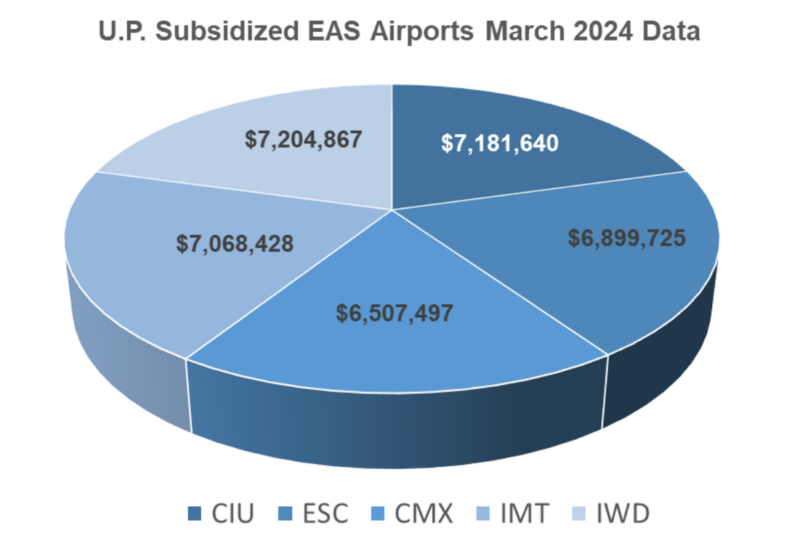

Created in the wake of the 1978 Airline Deregulation Act, the EAS program’s intent is admirable: ensuring more than 160 small communities throughout the nation maintain reliable and timely access to the national air transportation system. The program does so by establishing minimum levels of service at designated airports and paying to fill seats on flights as necessary to meet that minimum. In the Upper Peninsula, we have five EAS airports: Houghton County (CMX), Chippewa County (CIU), Iron Mountain ( IMT), Delta County (ESC), and Gogebic-Iron County (IWD).

There’s little doubt the EAS program has helped ensure service to areas that otherwise wouldn’t have access to that service. And it has helped protect that service during times of turmoil. For example, when some of our neighboring airports were switched to TAG routes earlier in 2023 (routes with a stop or two between the origination airport and the hub), the EAS contracts provided leverage to return those to direct flights within a few weeks.

However, MQT is missing from the EAS list. That is because the airport has more than one carrier, a distinction that makes it ineligible to participate in the program. Historically, this has served us well by providing several flights daily to multiple hubs, including Detroit, Minneapolis, and Chicago, making MQT the default choice for the entire region due to its competitive prices and schedule options. However, with EAS in place, dropping flights from a non-EAS airport becomes more beneficial since there is no revenue guarantee attached to those flights.

In 2024, EAS contracts cost more than $34 million at the five airports in the Upper Peninsula. In essence, MQT is competing not with other airports but with the federal government. Even if MQT were to meet the single-carrier requirement in the future, EAS is not open to new airports.

Despite this challenge, it is important to remember that MQT had up to five flights a day prior to 2020, which indicates that with the right policies and tools, more daily flights can be supported at MQT.

Investing in Marquette Sawyer

While efforts are actively underway to retain and attract more air service, efforts are also continuing to invest in the airport’s infrastructure to make the overall travel experience better. The significant investment made to airfield improvements and facilities is shown below. For context, the annual operating budget for Marquette Sawyer Regional Airport is $2,709,594 in 2024.

Past Capital Improvement Costs

Air Field Improvements:

- 2015/2016 – Airport Security and Fencing Improvements $753,148

- 2017/2018 – Runway rehabilitation/repaving $5,577,741

- 2018/2019 – Air carrier apron repairs $140,000

- 2022/2024 – Taxiway pavement rehabilitation $9,491,235

Total $15,962,124

Snow Removal Equipment and Facilities:

- 2018/2019 – Runway snow broom (Local Only funded) $612,000

- 2019/2020 – Runway snow plow with liquid spreader $519,130

- 2020/2021 – Runway liquid storage facility and airfield pavement maintenance $474,793

- 2023/2024- Cares Act Snow removal equipment purchase $1,680,000

Total $3,285,923

Facility Improvements:

- 2019/2023 – Hangar expansion and improvements (Hangar 665) $10,346,434

- 2022/2024 – Hangar improvements (Fire Suppression Hangar 664) $3,000,000

- 2023/2024 – Building 608 improvements $3,505,417

- 2023/2024 – Building demolition of 14 buildings $3,384,708

Total $23,522,482

The total cost of the listed items – $39,754,606

Future Projects

Marquette Sawyer Regional Airport (MSRA) continues to plan for improvements throughout the operation. Over the next three years, MSRA is planning for projects accounting for over $23 million. The projects address:

- Airfield Parking Aprons, Taxiways and Runways $10,965,096

- Potential Terminal Construction Work $17,364,934

- Air Traffic Control Tower work $ 3,500,000

- Aircraft Rescue Equipment $1,111,112

These projects are contingent on FAA Funding. These requests are based on available grants with an estimated local share of $1,136,832.

Airport Annual Operating Budget

2023- $2,591,144

2024 – $2,709,594

The budget revenue is generated through various revenue streams, i.e. leases, parking fees, and fuel flowage fees. The operation does not cash flow every year, but over these last few years, Marquette County has been able to account for much of the operating costs of the Cares Act Grant.

Major Tool: Minimum Revenue Guarantee (MRG)

One of the most impactful things we can do to make additional service to MQT more appealing to airlines is to remove the financial risk involved in starting and operating new routes. To do this, airports often offer a Minimum Revenue Guarantee (MRG). An MRG commits certain funds to airlines if regular operations of the route fall below defined expectations. It is a tool that is only used if established benchmarks are not met. In July 2023, Marquette Sawyer was awarded $750,000 from the Michigan Department of Transportation to support an MRG. Research suggests that an MRG should be greater than $1,000,000 in order to be attractive to airlines. Local stakeholders, including the LSCP and InvestUP, are actively searching for additional funds.

An MRG was successfully used previously to attract the Marquette-Minneapolis flight. Ultimately, the route was so successful the MRG was never accessed, but its presence was necessary to convince airlines to take the risk. Conversations indicate that an MRG is likely a more effective tool to solicit additional regional carrier service than direct major airline service.

* https://www.thrustflight.com/pilot-shortage/