The Lake Superior Community Partnership recognizes the importance of a diversified housing ecosystem and has identified the current housing opportunities available in Marquette County as a critical barrier to additional business investment.

New housing development has fallen well behind historic trends, setting the stage for a shortage of housing options. This was amplified by the 2020 pandemic, which increased the demand for housing in rural communities that offered a high quality of life and access to recreational assets, such as Marquette County. Housing shortages have also been amplified by an increase in short-term rentals, which generally provide a higher return on investment. The LSCP also recognizes that new development is facing historically high material costs, outdated regulatory processes, a shortage of skilled trades workers, and cash flow challenges. This increased demand and constrained supply has led to historic increases in pricing, placing the average home in many parts of the county out of reach of a family making the median income. This, in turn, is having an impact on our area’s ability to retain and attract new workers to the area. Given our area’s attractiveness as a climate haven, demand is only expected to grow.

We believe a healthy market consists of all types and price points, including single-family, missing middle, apartments, condos, and more. The LSCP is encouraged by a significant pipeline of potential housing projects in the county and new tools coming online through state and federal resources. In collaboration with its partners, LSCP will take a leadership role in facilitating the local conversation and encouraging new development through a variety of methods to add to this existing pipeline.

LSCP Housing Strategy Framework

The LSCP Board of Directors has adopted a Housing Strategy Framework to help guide the LSCP’s work in this area by understanding the various needs and partners also working to address this issue. You can read the strategy framework below.

Housing Target Market Analysis

In 2023, the Marquette County Land Bank Authority, the LSCP, and Marquette County Intergovernmental Housing Task Force members secured funds to complete a Target Market Analysis. A TMA aims to better understand existing demand for housing in an area, putting real data on paper to support or refute anecdotal evidence that otherwise can be widely used in housing discussions. The study suggests Marquette County can absorb up to 980 new units a year and rehabilitate up to 1,445 units a year. The TMA includes data on a countywide scale as well as seven local government units.

The full TMA documents are available below. To discuss the data in further detail, you can also contact cgermain@marquette.org or aadan@mqtco.org.

Marquette County Housing Target Market Analysis tutorial, presented by: Sharon Woods, LandUseUSA

Housing Development Tracker

One of the items identified in the housing framework is for the LSCP to maintain a listing of known housing developments. The Marquette County Land Bank Authority Housing Specialist maintains this spreadsheet, which is updated quarterly based on information provided to the LSCP and Land Bank Authority from local governments and other partners. Ultimately, the intent is to provide a public version of this information. Until then, you may reach out to cgermain@marquette.org or aadan@mqtco.org if you have questions.

Statewide Housing Plan and Regional Housing Action Plans

In 2022, the Michigan State Housing Development Authority (MSHDA) released the first Statewide Housing Plan. The plan calls for adding more than 75,000 new housing units statewide through a combination of affordable units, market-rate units, home ownership expansion, rehabilitation, and more. To assist with regionally relevant implementation, MSHDA funded local Regional Housing Partnerships. Marquette County is located in Region B, with efforts led by the Central Upper Peninsula Planning and Development Region (CUPPAD) and Community Action Alger Marquette (CAAM). You can read the Statewide Housing Plan and the Regional Action Plan below.

If you’d like to get involved in the Regional Housing Partnership, please reach out directly to Ryan Soucy at rsoucy@cuppad.org.

Redevelopment Ready Communities (RRC)

Establishing common-sense, streamlined regulatory processes is a critical component of unlocking new housing opportunities. Thanks to efforts from our local government partners, all three cities in Marquette County have achieved a designation from the Redevelopment Ready Communities (RRC) program, which signifies that they have removed regulatory and policy barriers to new investment. This includes a focus on housing-related zoning provisions and development review processes. Below are resources from those communities to help facilitate your next project in their jurisdiction.

The LSCP can help connect you with the appropriate contact(s) within each local government to learn more.

City of Ishpeming

City of Marquette

City of Negaunee

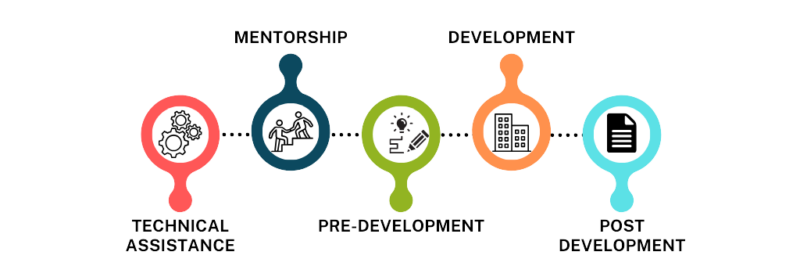

Become Part of the Solution – Add ‘Developer’ to your Resume

Ultimately, it will take a comprehensive approach to building new units, rehabbing old units, adding single-family homes, missing middle housing options, and large-scale workforce housing developments to move the needle. We’ll need to work together to align capital, materials, labor, land, local permitting, and more. To do that, we’ll need existing developers – large and small – and new ones! If you’ve ever considered improving the value of your existing home or vacant property, you’re on the cusp of being a developer. Below are some resources to help you make the leap.

- MEDC Developer Toolkit

- CEDAM Real Estate Development Bootcamp

- Incremental Development Alliance

- How to Get Started as a Small-Scale Developer (Strong Towns)

- How to Become a Small-Scale Developer (National Association of REALTORS)

- Local Emerging Developer Meet Ups (contact aadan@mqtco.org)

Available State and Local Incentives

There are countless tools now available to help close financial gaps in building new or rehabbed housing. Below is a list of the most commonly used state and local incentives. Consider these public sector investments in our collective goal of adding new housing. The LSCP and our partners can assist with navigating these tools and connecting you to the right contacts for more information. This list is not exhaustive.

Michigan Economic Development Corporation (MEDC)

- Website: www.miplace.org | www.michiganbusiness.org

- Community Revitalization Program (commonly mixed-use, downtown-focused)

- Build MI Community (focused on emerging developers)

- State Brownfield Incentives and Programs (variety of uses)

Michigan State Housing Development Authority (MSHDA)

- Website: www.michigan.gov/mshda

- Missing Middle Housing Program (MMH)

- Multifamily Direct Lending Programs

- Housing Tax Increment Financing Program (TIF)

- Low Income Housing Tax Credits (LIHTC)

- Housing and Community Development Fund (HCDF)

- Tribal Nations Housing Development Assistance

Michigan Opportunity Zones

- Website: https://miopportunityzones.com/

- Established in the 2017 U.S. Tax Cuts and Jobs Act, Opportunity Zones offer incentives for patient (long-term) capital investments all over the nation in low-income communities in which investment has been sparse and growth of businesses has been minimal. There are three types of tax incentives that relate to the treatment of capital gains. Each of the incentives is connected to the longevity of an investor’s stake in a qualified Opportunity Fund for 10 years or more.

Build U.P. Housing Development Fund

- Website

- Build U.P. as a long-term, sustainable fund to provide impact in addressing the UP-wide lack of housing. The program, run locally in the Upper Peninsula, provides two options to help new projects come to reality: a cash collateral program and a residential infrastructure loan program.

Marquette County Brownfield Redevelopment Authority

- Website | 2023 Annual Report

- The MCBRA provides various tools to assist with removing barriers to the redevelopment of brownfield sites.

Marquette County Land Bank Authority

- Website | 2023 Annual Report

- The mission of the Marquette County Land Bank Authority is to collaborate with local governmental units and community organizations to determine the best way to return tax-foreclosed and undervalued properties to the tax roll while eliminating blight, providing attainable housing and economic development opportunities, and revitalizing communities.

Local Government Tools and Opportunities

- Local governments in Marquette County can offer a number of potential tools including Neighborhood Enterprise Zones, Housing Tax Incremental Financing (TIF) plans, Payment in Lieu of Taxes (PILOT) agreements, brownfield TIF, reduced land prices, waived permitting fees, etc.

Local Financing Institutions

You’ll find a wide variety of local financing institutions right here in Marquette County. Many are investing members of the Lake Superior Community Partnership, so you can feel confident they provide great services, are active in the community, and are up-to-speed on development trends in the area. Check out the “Financial and Insurance” category in our business listing for contact details. Note: This is not a comprehensive list of financing institutions, only those who are active LSCP members

Contacts

The LSCP has teamed up with many partners to facilitate new housing development. Below are key contacts for some of those partners.

Christopher Germain, AICP | EDFP

Chief Executive Officer

Lake Superior Community Partnership (LSCP)

(906) 226 – 6591 (office)

(906) 202 – 3710 (cell)

cgermain@marquette.org

Antonio Adan

Housing Specialist

Marquette County Land Bank Authority (MCLBA)

(906) 225 – 8164 (office)

(906) 362 – 6060 (cell)

aadan@mqtco.org

Ryan Soucy, AICP

Senior Community & Economic Development Planner

Central U.P. Planning and Development (CUPPAD)

(906) 339 – 1371 (cell)

rsoucy@cuppad.org