UPDATE REGARDING WAGE AND OVERTIME RULES: A federal judge in Texas has issued a nationwide injunction to halt the implementation of the new wage and overtime rules. This case was brought by 21 states and argued that the administration exceeded its statutory authority in raising the salary limit. It is not clear when the case will be heard and decided, but the injunction is effective immediately, which means that the December 1 effective date for the regulations is not applicable.

U.S. Dept. of Labor Overtime Rules (FLSA Exempt/Non-Exempt Employees)

- On July 6, 2015, the U.S. Dept. of Labor (DOL) issued a notice of proposed rulemaking that would change the regulations that exempt administrative, executive, and professionals from the Fair Labor Standards Act’s minimum wage and overtime requirements.

- Often, these exemptions are referred to as the “white collar” exemptions.

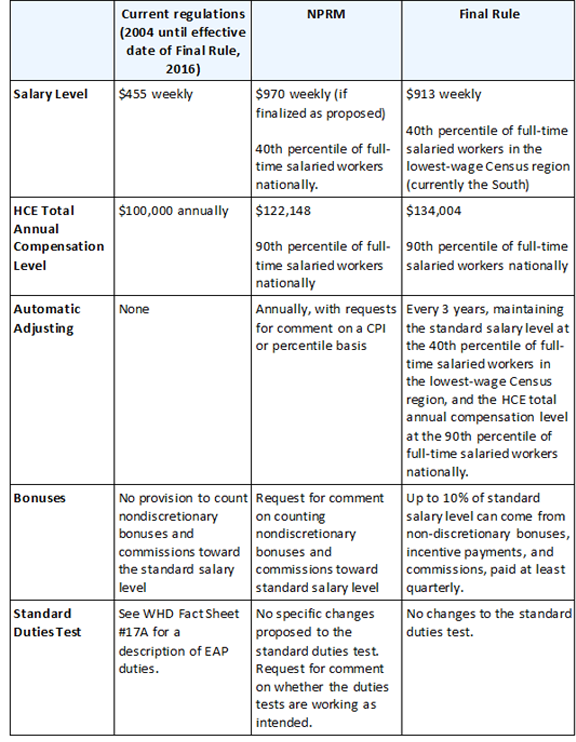

- The proposed rules would change the current salary threshold for exemption employees from overtime pay from $455 per week ($23,660 per year) to $913 per week ($47,476 per year). That equates to an over 100 percent increase.

- Employers impacted by the rule change will have to increase employee compensation to meet the threshold, or begin paying overtime. Effective December 1, 2016.

- Future automatic updates to salary level to occur every three years, beginning on January 1. 2020

- No change to duties tests

- We recommend that all employers and partners should conduct an audit of their wage and hour practices to 1.) ensure that all employees and independent contractors of the business are properly classified; 2.) ensure all employees are paid the proper minimum wage; and 3.) determine how many employees may be subject to the new overtime rules once they go into effect.

- Exemptions

- This link is to a Wage and Hour Division page on the FLSA generally that lists the broad categories of exemptions. It does not give the specific duties. https://www.dol.gov/compliance/guide/minwage.htm

- This link goes to a page that deals with the white collar exemptions and gives some descriptions of the duties with links to more detailed descriptions. https://www.dol.gov/whd/overtime/fs17a_overview.htm

- This link goes to an index of all the fact sheets and under “Exemptions” the various specific exemptions are listed with fact sheets describing them. https://www.dol.gov/whd/fact-sheets-index.htm

- DOL Wage and Hour Division Overtime Rules webpage: https://www.dol.gov/whd/overtime/final2016/

- Notice the “Additional Information” links at the bottom of the page.

How do the current regulations, proposed rule and final rule compare?

Here are a few helpful links:

- Webinar on the DOL Overtime Rule

- Preparing for Change Power Point

- FLSA Overtime Rule Resources

- Wage and Hour Division – Q & A

- The Overtime Rule – The final rule will

- Final Rule: Overtime

- Sample Letter to Senator Stabenow

- Sample Letter to Senator Peters

- Sample Letter to Congressman Benishek

- Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales and Computer Employees

- Fact Sheet

- Article: Working Overtime to Avoid the Truth